How Business Schools Will Change After COVID-19

Business schools teach ‘business as usual’ topics. This is understandable as they are the tools that we use the most on a day-to-day basis. Typical courses in strategy, finance, accounting, economics etc. study how things work in ‘normal’ conditions.

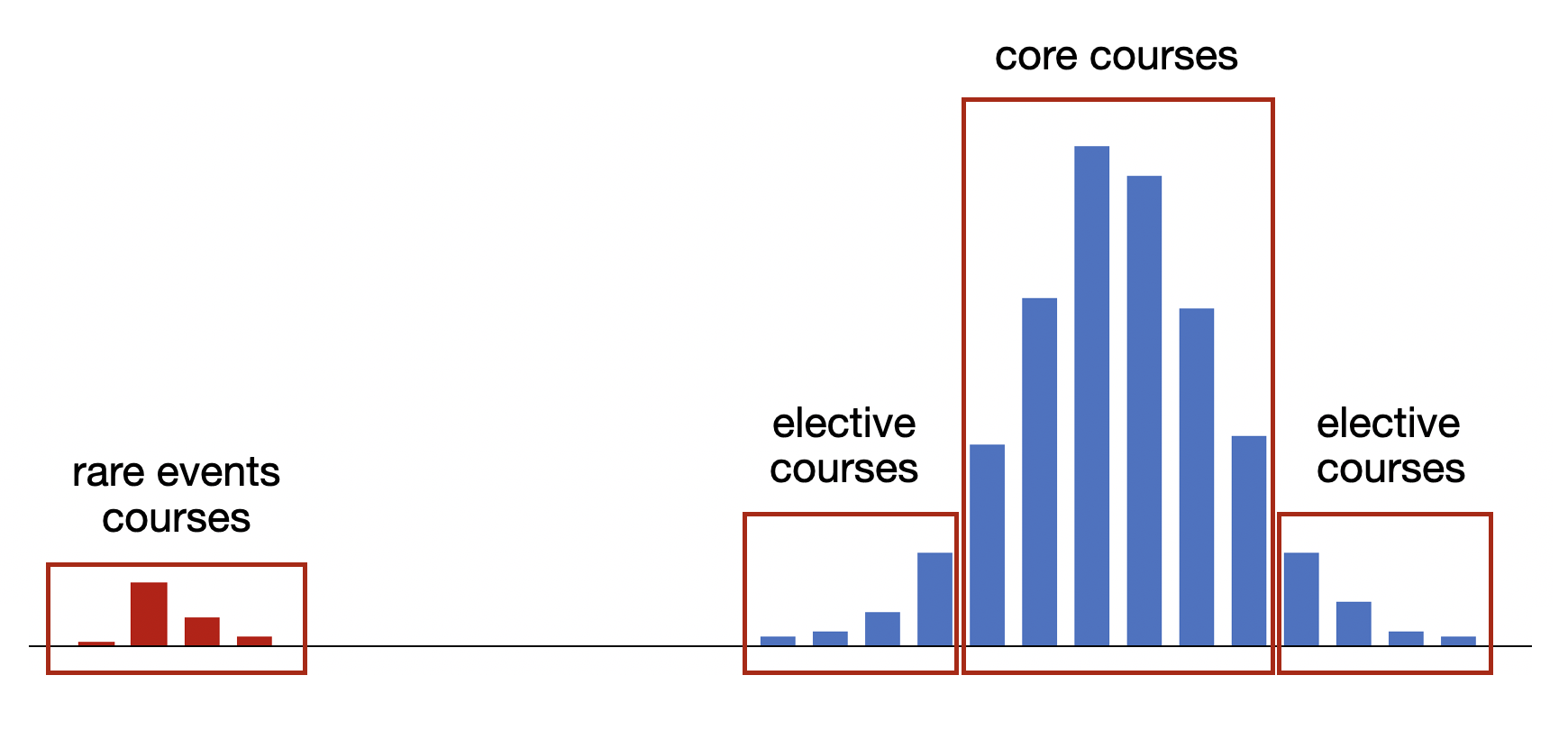

This is of course very important and should not be changed. Business schools today have core courses, aiming at setting the foundation of common business practices, and elective courses, aiming at giving managers the extra edge to deal with out-of-the-ordinary situations such as corporate turnarounds, cultural changes and business innovation.

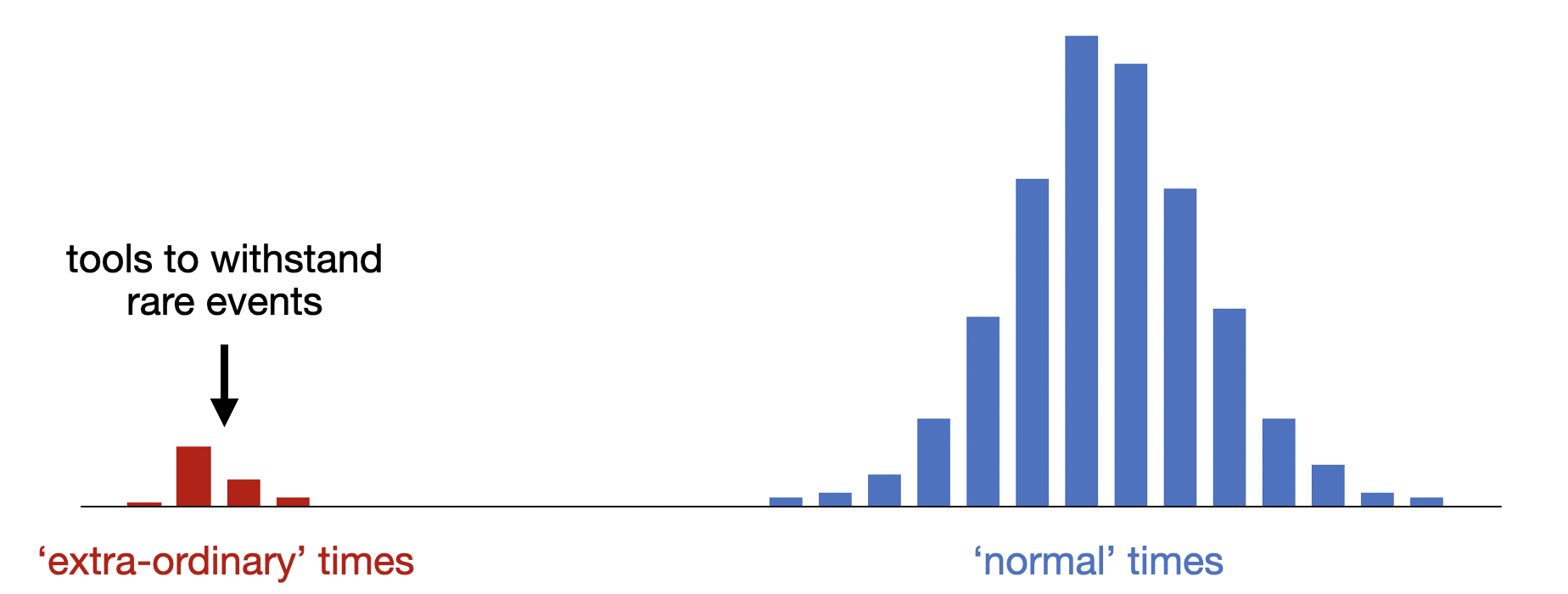

The following histogram shows the number of times we use traditional business tools in ‘normal’ times.

The ‘business as usual’ frameworks are the most widely used and represent the foundation for every manager.

Additionally, business schools also teach tools to give managers that extra edge to outperform competitors and to deal with complex problems such as corporate restructurings, organisational change, etc.

Because of globalisation, economies worldwide are more integrated and therefore also more correlated. Events happening in one region of the world will, most probably, have a significant impact on other regions and vice versa. But the severity of the impacts is not fixed and can vary between high and low levels.

When the global economy is functioning well, the impact of local events can be absorbed. For example, you can switch to alternative suppliers, alternative markets or find new production sites.

Before the virus outbreak, the debt crisis in Argentina or the yellow vest movement in France had little effect on the wider world economy. However, in the case of certain events, correlation can rapidly converge to +1.00 creating severe consequences.

COVID-19 is an example of this.

The fact that correlation varies depending on how the economy is performing is what we call correlation skew.

High correlation can lead to events that might have severe economic, political and social effects; we can call them ‘rare events’. As globalisation increases, so will the occurrence of rare events.

We do not need to fear them, but we do need to learn how to deal with them. How does that fit into the business world? Well, managers need more tools. Tools that can go beyond traditional frameworks. Tools to withstand rare events.

Business schools’ courses will need to adapt.

Core courses need to stay, there is no doubt about that as they provide the day-to-day tools for managers. Elective courses will stay too, as everyone should have the freedom to learn what they are interested in.

In addition to core courses and electives, we might see the emergence of a new type of course.

COVID-19 might have just triggered an academic revolution by pushing business schools to start teaching new topics. Every manager should not only understand and be able to perform in ‘normal’ times. Where managers and leaders should be adding real value is in complex and ‘extra-ordinary’ times and situations.

The next generation business schools will not only have core and elective courses, but we will also offer a selection of new ‘rare events’ courses aiming at giving managers the tools to withstand unusual circumstances.

A whole new area of business studies will emerge from this:

- ‘Rare events strategy’: how do you rapidly re-invent yourself in situations of severe short-term shocks

- ‘Alphabet macroeconomy’: understanding an economy that can be either V-shaped, U-shaped, W-shaped or inverted-N-shaped

- ‘Freediving corporate survival’: how to survive major economic shocks by hitting the pause button until a new start is possible

- ‘Layering economy’: how certain sectors and industries can totally decouple and follow a totally asynchronous and uncorrelated evolution

- ‘Psychology of decentralised work’: what are the long-term consequences of a lack of workplace belonging due to remote working?

But COVID-19 is only one example of rare events and more academic analysis is needed in the future to fully understand the impact of other similar rare events.

Other rare events are likely to happen with serious consequences: imagine the impact of a prolonged global cyber-attack, which would have deep consequences on our life; a severe and extended solar storm (also called Carrington event), which would significantly impact telecommunication worldwide; or a new Tunguska event, an explosion caused by the impact of an icy comet.

These are exciting times to be an academic, but will business schools really start teaching topics that nobody might need for many decades to come? When we will be back to ‘normal’ times, few might be willing to spend time and money to study ‘rare events’.

Many might be much more interested in having an immediate impact when they will go back to their organisations, and core and elective courses are more appropriate for that. I will leave that decision to the Deans of INSEAD, Tsinghua, HEC, Columbia, Wharton, LBS and all the others. Let us know when you are ready, and we might all come back to school very soon.