INSEAD MBAs flex their impact investing muscles

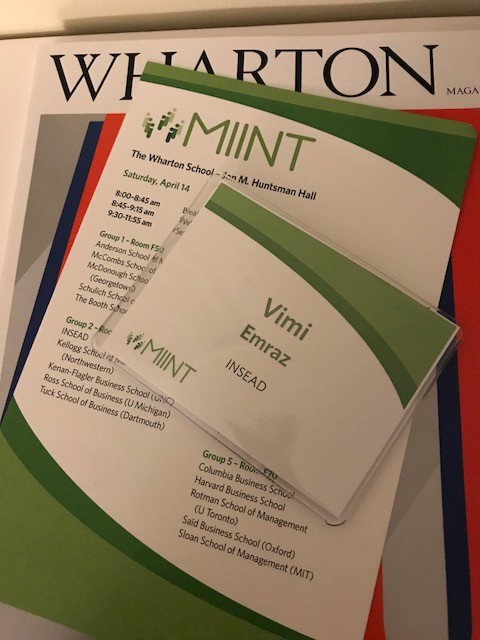

Last April, the INSEAD Career Development Centre accompanied a team of 18J MBAs to the MBA Impact Investing Training and Network (MIINT) competition, organised by Bridges Fund Management in conjunction with the Wharton Social Impact Initiative.

Our MBAs are exploring the world of social impact through classes, electives, internships, company treks, and other social impact activities on campus. Added to this, the competition provides a valuable experiential learning opportunity and dovetails well with INSEAD’s mission to use business as a force for good, developing responsible, thoughtful leaders and entrepreneurs to have a positive impact on their businesses, the world, and communities. We are the Business School for the World!

MIINT taps into the burgeoning desire of MBAs everywhere to get involved in impact investing and aims to train the millennial generation to "think like an impact investor”. Twenty-five business schools go head to head (INSEAD won the competition in 2017). Teams complete in eight online training modules that guide them through the sourcing and diligence process, submitting eight deliverables and selecting a seed-stage company for potential investment along the way. There are regular online calls with Bridges to keep everyone on track and answer questions. Aside from the technical skills gained through the online modules and the exposure to leading impact investors in the field on the day of the competition (opportunity to have individual conversations with Acumen, Liquidnet, Omidyar to name just a few), the competition also brings together like minded, mission driven MBAs who could be future entrepreneurs or future investors. As everyone will tell you, it is all about the networks!

The competition culminates in a final presentation in front of an investment committee where each school presents their selected company to a judging committee of industry experts and compete for an up to $50,000 investment into the company (investment capital provided by a third party supporter of MIINT).

The INSEAD team started the journey in October 2017, reaching out to their own network and also tapping into the school’s global network of INDEVOR (our social impact club), alumni, entrepreneurs in residence, and came up initially with 60 social enterprises. The whole process, from the kick off call with Bridges to the competition day at Wharton mid-April lasts for 6 months. This is heavy investment for INSEAD students on an accelerated 10 month MBA programme. Additionally the MIINT finals landed in the middle of recruiting. As any INSEADer will tell you….the MBA teaches you prioritisation skills as there are just so many opportunities on the programme.

What were the challenges along the way? One of the team members, Kieran Beck says "Sourcing! Finding the right start-up was an extensive process. It was challenging getting good information flow from potential companies quickly; we needed multiple calls / emails to determine whether they were a genuine candidate or not".

From a list of sixty companies, the team put forward SafetyNet Technologies (SNTech) who have developed a LED-device that reduces by-catch, and so addresses the issue of sustainable fishing, and preserving bio-diversity. This aligns with UN Sustainable Goal 12 (Responsible Consumption & Production) and Goal 14 (Life Below Water). The start-up is a team of three, including INSEAD MBA ‘14J, Nadia Laabs who is their Strategy Lead. INSEAD 18J Walter Fernandez said "we felt we were pitching a company that could deliver real impact."

Competition day. The twenty-five teams are split according to themes. INSEAD, Kellogg, Kenan-Flagler, Ross and Tuck, all presented a business addressing food and agricultural issues. Needless to say MIINT is dominated by US schools, with INSEAD being one of five European schools competing. Interestingly two of the businesses in our group focused on changing our eating habits by reducing meat consumption and promoted eating insects.

One talked about converting livestock farming to insect farming and thereby reducing land and water usage, and green gases; the other business produces cricket powder for use in pet food, snacks for humans and sells frozen or roasted crickets to restaurants.

Bugs aside, we also heard about a company working with small family farmers to freeze, market, and distribute locally grown produce. The fifth team presented a SaaS platform connecting smallholder farmers, distributors, buyers in the local food ecosystem.

There were some common themes of traceability and our relationship with those who produce the food we eat. The five schools were grilled on the management team of their businesses, the technology, adoption by customers, and alignment between financial and social returns.

The judges from the five different groups then debriefed whilst we heard from Ross Laird, the founder of Village Capital, on The Innovation Blind Spot (the title of his book).

Next round. The semi-finalists were Booth (education), Kellogg (food), Yale (environment), LBS (healthcare) and HBS (coffee) who presented again in front of all participants and the whole panel of judges. Intense Q&A from the judges! The INSEAD team noted that the majority of companies sourced were US focused and addressed local/regional issues.

The outcome was that MIINT will make 3 investments to the companies put forward by Yale, LBS and Booth.

Although we did not retain the title, all five INSEADers were thrilled to participate and to gain some familiarity with impact investing. Sola Jagun, INSEAD 18J, said she felt aligned with the schools philosophy of using business as a force for good and it was a great opportunity to see how she could have impact in her career through impact investing.

So what were the key learnings from this experience? The team would offer the following advice to future INSEAD MIINT participants:

- Eliminate companies quickly against the MIINT criteria

- Put more weight / emphasis on companies that are revenue positive / have an operational track record

- Practicing the pitch is very important. Leverage INSEAD friends from social impact or from venture capital and the Entrepreneur in Residence to refine the final presentation and Q&A

As for me, I was impressed by the extensive social impact offering at other top schools. Food for thought as INSEAD launches the Institute for Business and Society. In the words of Dean Ilian Mihov,

"This aspiration is a direct expression of our founders’ vision that business must be a force for good."

I have to also say a big thank you to our alumni community for supporting our students in their social impact endeavors, not just for their time but also for donations to our social impact fund which supports MIINT and internships in social impact.

Finally...we cannot wait to for MIINT 2019!

# INSEAD #18J # impactinvesting # MINT2018 #socialimpact #safetynet